south dakota excise tax on vehicles

In South Dakota an ATV MUST be titled. Ad SD Contractors Excise Tax Return More Fillable Forms Register and Subscribe Now.

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue

The South Dakota Department of Revenue Pierre SD ITEMS OF NOTE.

. The purchaser requests and. We specialize in traditional and digital mail SD domicile and South Dakota Vehicle Registration. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Search for jobs related to South dakota excise tax on vehicles or hire on the worlds largest freelancing marketplace with 21m jobs. Chapter 10-36 Rural Electric Companies. The South Dakota excise tax on cigarettes is 153 per 20 cigarettes higher then 54 of the other 50 states.

Section 32-5B-1 - Imposition of tax--Rate--Failure to pay as misdemeanor. Motor vehicle purchased prior to the June 1985 4 excise tax law. 84-Insurance company titles vehicleboat and does not pay 4 excise tax.

All the documents you need to register fast. We also provide an onsite hotel campground Vehicle Insurance agency and notary services. South Dakotas 8000-mile networks of highways and airport runways are essential to the states economy and its citizens quality of life Fuel taxes are used to fund.

Vehicles in South Dakota. Mobile Manufactured homes are subject to the 4 initial. That is subject to sales tax in South Dakota.

South Dakota Documentation Fees. Sales and excise taxes are two separate taxes that many people pay attention to because they. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial.

Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car. Vehicles that have not been titled or registered in the US.

Insurance company titles vehicleboat and does not pay 4 excise tax. Motor vehicles are not subject to the motor vehicle excise tax if. 32-5B-13 - Licensing and titling of used vehicle by dealer--Payment of tax by subsequent purchaser.

No excise taxes are not deductible as sales tax. South Dakota charges a 4 excise sales tax rate on the. Business Tax includes sales tax use tax tourism.

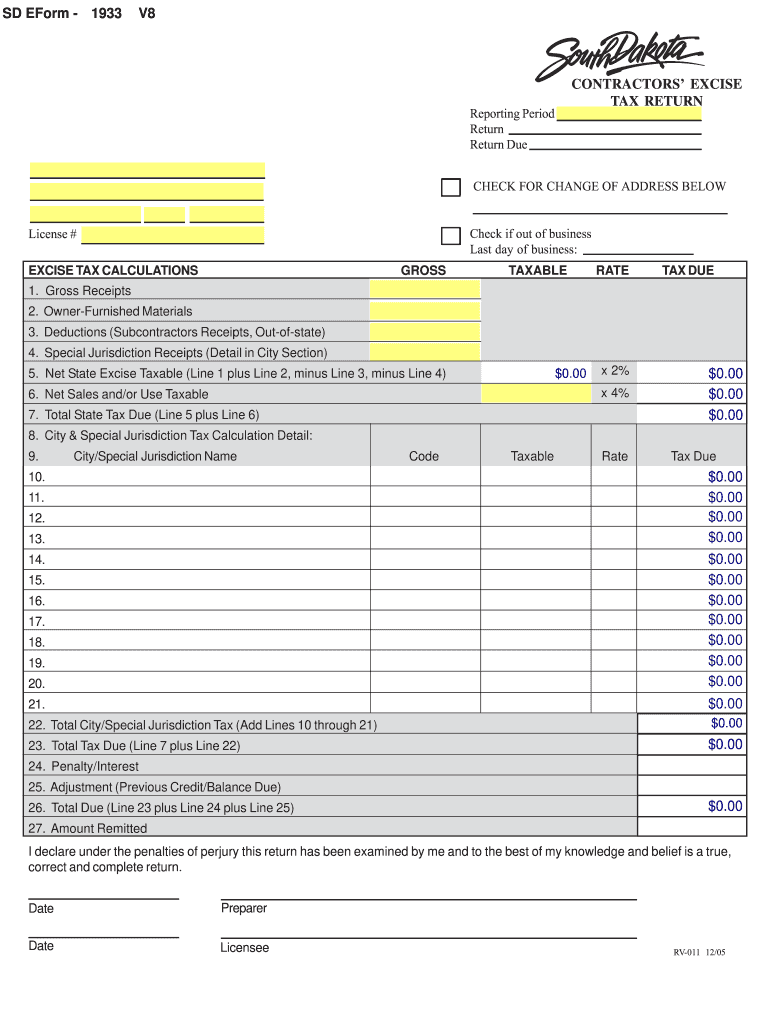

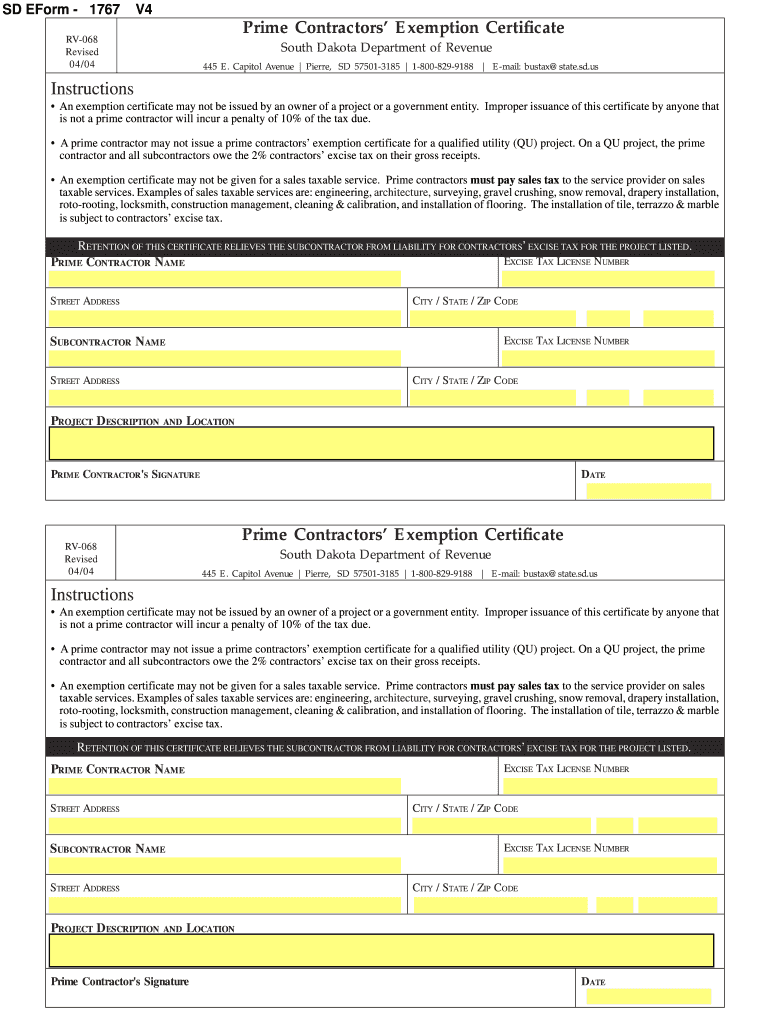

Motor Fuel Excise Taxes. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. 2010 South Dakota Code Title 32 - MOTOR VEHICLES Chapter 05B - Excise Tax On Motor Vehicles.

Its free to sign up and bid on jobs. South Dakotas excise tax on cigarettes is ranked 23 out of the 50 states. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax.

32-5B-14 - Licensing and payment of excise tax on new vehicle by dealer. Plates are not removed from vehicle. However if purchased by an out of state business you will need to.

Average DMV fees in South Dakota on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above. Chapter 10-35 Electric Heating Power Water Gas Companies. Imposition of tax--Rate--Failure to pay as misdemeanor.

Uses the product or service in a municipality that. In addition to all other license and registration fees for the use of the highways a person shall pay an excise tax at the rate of. By the applicant will be subject to the 4 excise tax as of the date of this documentsubject to law changes If the purchase.

This report is a list of Business Tax delinquent taxpayers 2.

Excise Taxes Excise Tax Trends Tax Foundation

Cars Trucks Vans South Dakota Department Of Revenue

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out Sign Online Dochub

Excise Taxes Excise Tax Trends Tax Foundation

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

What Is The Gas Tax Rate Per Gallon In Your State Itep

Full Time Travelers Dakotapost

South Dakota Exemption Certificate 2004 Form Fill Out Sign Online Dochub

What Is Excise Tax And How Does It Differ From Sales Tax

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Why Do So Many Rvs Have Montana And South Dakota License Plates Outdoorsy Com

Contractor S Excise Tax South Dakota Department Of Revenue

Car Rental Taxes Reforming Rental Car Excise Taxes

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

When Excise Tax Feels Like Excess Tax Hagerty Media

Hundreds Of Sd Bridges Intolerable Despite Transportation Funding

When Excise Tax Feels Like Excess Tax Hagerty Media

South Dakota Income Tax Tax Benefits South Dakota Dakotapost